Revitalizing tourism activities has become one of the primary concerns for the Philippines. In the short run, domestic tourism is expected to play a vital role in supporting the initial recovery phase of travel. With its presumed impact on travelers’ behavior and business operations, an analysis of the Filipino travelers’ sentiments and the existing domestic travel market is necessary in presenting effective strategies in the midst of the new normal in Philippine travel.

Introduction

The Philippine tourism economy has been heavily hit by the measures implemented to contain the spread of COVID-19. The pandemic has prompted an unprecedented crises with projections and revised scenarios suggesting that the shock in global tourism could be at 60-80% for the entire 2020, translating to a loss of approximately 67 million international arrivals or USD 80 billion in exports from tourism, while putting 100 to 120 million direct tourism jobs at risk. While affecting all economies, the Asia-Pacific region has been projected to suffer with the highest impact, affecting about 33 million arrivals (United Nations World Tourism Organization [UNWTO], 2020).

Tourism is a significant pillar in many economies in the region, especially in the Philippines, where in 2019, it contributed 12.7% share in the country’s GDP, and employed 14 out of 100 or 5.7 million of Filipinos (Philippine Statistics Authority [PSA], 2020). Following the outbreak of the pandemic, estimates for the first three months of 2020 suggest that revenue from foreign arrivals decreased by 35%, and employment in the industry may be reduced by about 33,800 to 56,600 (CGTN, 2020). Several months into the implementation of stay-at-home and quarantine policies, travel in the Philippines remains uncertain. Travel restrictions and limits in people-to-people interactions are likely to be in place for a long period of time, thus bringing the industry to a standstill.

With the expectation that domestic travel will recover faster than international tourism, insights on the possible strategies that can help bootstrap the Philippine tourism economy should be discussed. Critical to this approach is an understanding of the Filipino travelers’ sentiments towards travel and a marketing analysis which scrutinizes ways to revive travel demand and resume operations in the face of the new normal in tourism. This article will look into the variety of conducted surveys regarding travel perceptions and will reintroduce the concept of space travel to guide the creation of strategies towards travel in the new normal.

Redefining Travel in the New Normal: The Filipino Travelers’ Sentiments

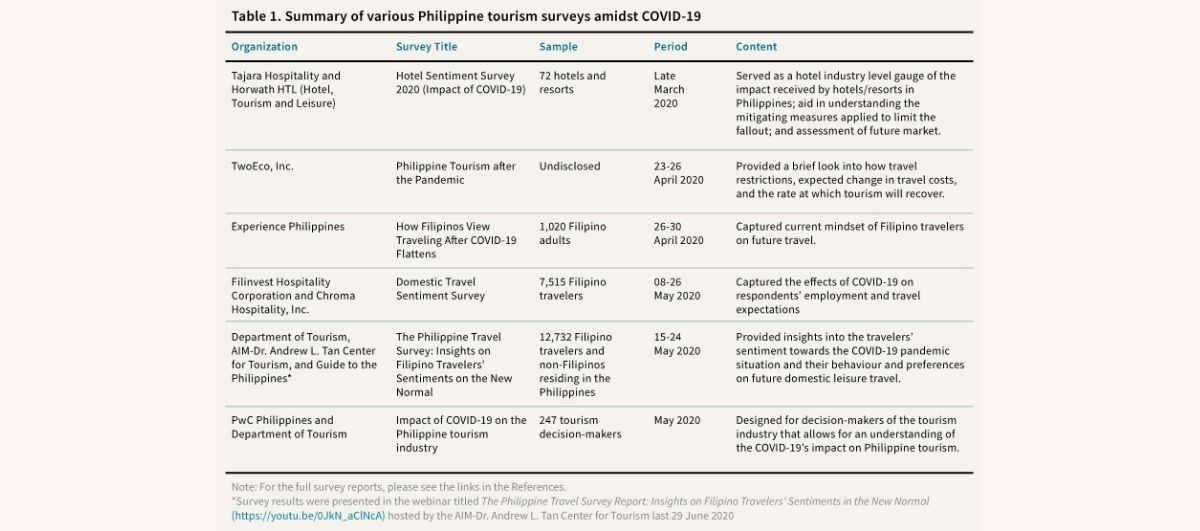

In these times of uncertainty in the outlook of travel in the Philippines, a data-driven approach to support the revival of the industry has become an imperative. During the period of March to May 2020, several public and private organisations deemed it necessary to conduct surveys to understand stakeholders’ perceptions on travel in relation to the pandemic. Given mobility restrictions, surveys have been conducted online while targeting a range of stakeholders from enterprises, decision makers, to tourists. Conducted in varying time frames, general survey results suggest that travel sentiments might have evolved over periods of time. Insights on travel perceptions are necessary in crafting strategies for tourism recovery. Thus, consumer perception on the future of travel should be taken into consideration in planning interventions and strategies. Table 1 presents the surveys conducted in relation to travel and pandemic.

Photo credit: https://bit.ly/3ag2GUz

From the results of the surveys, several insights about the future of travel in the Philippines were made: First, domestic travel will be a priority. Travelers opt to either engage in land travel or air travel. Second, travelers will prioritise travel in rural, secluded, and natural areas once restrictions are lifted. Travel away from mainstream and overcrowded destinations are expected, although beach destinations are still considered ideal destinations post-pandemic. Furthermore, due to the restrictions imposed by the pandemic, travelers are now more open to digital travel experiences. Similarly, travelers are likely to choose customised travel experiences over packaged group tours. Third, health and safety protocols will be their number one priority once travel resumes. Thus, effective communication of safety measures and protocols implemented in destinations and enterprises will greatly influence travel choices. Perception towards the health and safety in travel will therefore predict where travelers will travel, when they will be traveling, and what kind of experiences they hope to obtain. Fourth, while domestic travel is expected to resume within four to twelve months after easing of travel restrictions, sentiments are primarily dictated by perceptions on public health and safety. Finally, given that the pandemic has affected people’s source of income and their personal finances, travelers seek more cost-effective experiences.

Re-Introducing Space Travel

As emphasised in the webinar entitled Space travel: A conversation on strategies to revitalize Philippine tourism post-COVID-19 (https://www.youtube.com/watch?v=Zq-Co_DWg8E) hosted by the AIM- Dr. Andrew L. Tan Center for Tourism last 28 July 2020, much has been said about the world getting smaller, we forget that the world is actually big. There are still so many places to explore and to visit, much to learn and to unlearn. Overcrowding (i.e., mass tourism) is no longer an option because of the established physical/social distancing, health and safety protocols that require decongestion of tourist attractions. To care for earth by giving nature room to flourish, to give fellow travellers the room to breathe, to explore, to grow, to reflect and participate in the lives of others, and to give destination stakeholders time to recover from visitor activities is the essence of space travel. It is a literal practise of giving each other and the earth space.

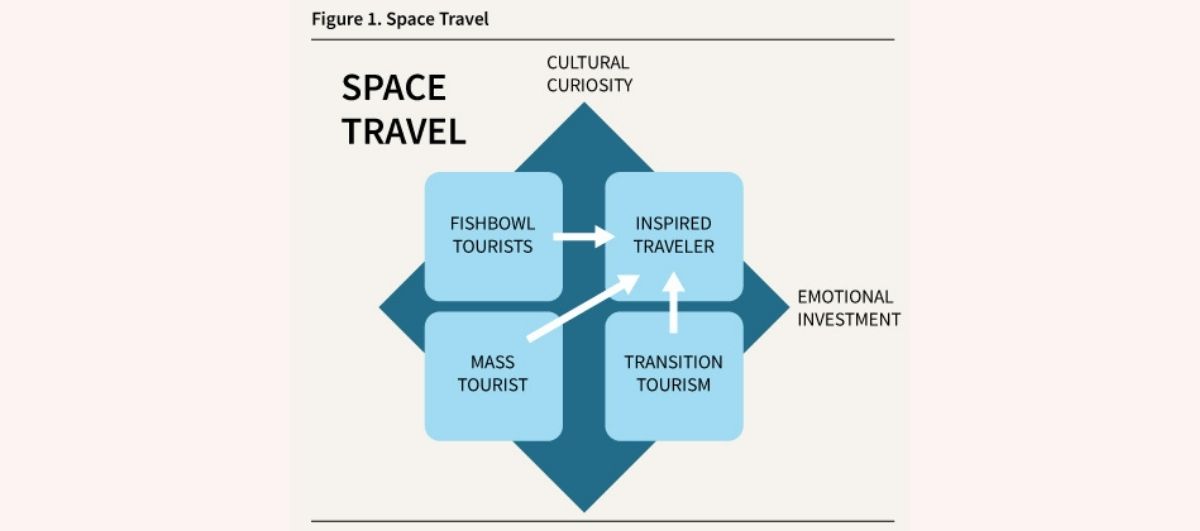

Tourists who routinely return to familiar destinations are considered second home tourists. These tourists are in the best position to care for a destination because they are invested in this as their go-to place for sanctuary. On the other hand, for those who travel to experience destinations from a distance, risking the alteration of local behaviour and culture are deemed fishbowl tourists. By including activities that increase their involvement in local custom, rather than just mere observation can transform these tourists and their attitude towards travel. Those who immerse themselves and make their experience a journey is called the inspired travellers, who imbibe sustainable tourism when they protect and safeguard the earth by their conscious defence and accountability of environments and travel behaviour.

Until restrictions are lifted and travelling returns to normal, tourism needs to adjust and adapt to reflect the present restrictions, initiating a new way of serving travellers called transition tourism. This type of tourism distributes the business amongst many stakeholders – accommodations, transportation, alimentation, security, and sanitation – in small groups triggering a collaborative rebooting of a local economy in many areas. Thus, for space travel to take root, transition tourism must inspire fishbowl and mass tourists to become inspired travellers (see Figure 1).

Photo credit: https://bit.ly/3ag2GUz

By working together, stakeholders and travellers alike, in stimulating local economies as a tight organism is to think small. It reduces the unwieldiness of the task of re-booting economies and industries. When each one of us does our little bits, we can save our big world by thinking small.

Moving Forward: From Crisis Response to Recovery

Further discussions, through webinars, have been initiated among experts and stakeholders on rebooting Philippine tourism. In the webinar titled Bootstrapping Philippine tourism: Recalibrating our priorities during and after COVID-19 (https://www.youtube.com/watch?v=3kNhIZqy92I) hosted by the AIM-Dr. Andrew L. Tan Center for Tourism last 03 June 2020, the following discussions have been featured: best practices on how tourism industries recover from disasters; strategies on how tourism stakeholders can manage COVID-19’s impacts; and insights on resilient recovery from a disaster risk-reduction management lens and how these can be applied for tourism recovery efforts.

During the webinar, Aileen C. Clemente (President, Rajah Travel Corporation) highlighted the following lessons from the pandemic: “it takes a while for people to get from philosophical discussion to general frame working to actual implementation”; “those who had a lot of excuses not to implement what needed to be implemented have no choice but to now implement them; and “greed has been tempered”. From these, Clemente cited the four stages of recovery as per the World Travel & Tourism Council – managing and mitigating the crisis, restarting the sector’s operations, reaching recovery, and redesign for the new normal.

In line with this, Maria Cherry Lyn S. Rodolfo (Consultant, Department of Tourism) explicated that the tourism industry must have a calibrated recovery plan, in which domestic tourism should be given priority. That is, tourism authorities and enterprises must incessantly develop safety and health protocols that will ensure domestic travel is safe, secure, and seamless. Rodolfo also emphasised that the pandemic warranted the need for “strong, innovative, and responsive network” in moving towards recovery, reset, and resiliency. Rodolfo also highlighted the role of “cohesive and collaborative networks” in tourism reboot. There should be: call to action for inclusive recovery assistance, innovation, infrastructure, and institutional strengthening; community engagement in utilizing the resources of networks and in leveraging local with national and international networks; and a communication plan that will cascade tourism reboot strategies to both existing strong and weak networks in the industry.

In doing so, Clemente argued that in the new normal, repositioning product offerings, raising levels of service, defining world-class destination, re-examining consumption of tourism products and services, and increasing awareness about mass tourism are essential. Similarly, Lesley Jeanne Y. Cordero (Senior Disaster Risk Management Specialist, World Bank) stressed that in transitioning towards the new normal, there is a need to redefine tourist experience and destination management; invest in innovative and creative ways of product development; promote sustainability, inclusivity, and resiliency; recalibrate travel timelines, concepts, spaces and experiences; shift and share burden by collaborating with government, stakeholders, communities and tourists.

Conclusion

While information about the impact of the COVID-19 pandemic has already dominated discourses on tourism, only a few discussions have been made regarding strategies to accelerate tourism recovery. With tourism activities at a standstill, an opportunity to adapt new models for conducting tourism activities has opened. More than ever, the role of tourism stakeholders in transitioning to the new normal has become more apparent.

In addressing the question on how tourism can recover after the COVID-19 pandemic, we analysed existing data regarding travel perceptions and conducted a marketing analysis to identify ways to revive travel demand and operations in the new normal. Our analysis suggest that existing business models may have become obsolete, thereby needing adjustments and re-assessments. While travel restrictions remain, transition tourism takes place. Crucial at this period is considering travelers’ perceptions and sentiments. Following the findings in the various surveys conducted, travelers are expected to engage in tourism activities with health and safety as their priority, which further suggests their preference towards natural areas and uncrowded destinations, digital travel, and customised experiences.

Reflected by these findings is a paradigm shift in the future of travel—from fishbowl tourism to inspired travellers, which also tantamount to a shift from mass tourism to a more sustainable form of tourism. However, this shift does not occur without the collaborative rebooting of the local economy by using local tourism as a springboard. Thus, stakeholders need to work together, along with tourists, to create a tightly knit industry that fosters thinking small.

References

- CGTN. (2020). Philippines Q1 tourism revenue dips 35% due to COVID-19. https://news.cgtn.com/news/2020-05-02/Philippines-Q1-tourism-revenue-dips-35-due-to-COVID-19-Q9MV8ZEnW8/index.html

- Department of Tourism, Dr. Andrew L. Tan Center for Tourism, & Guide to the Philippines (DOT, ALTCFT, GTTP). (2020, June). The Philippine Travel Survey Report: Insights on Filipino Travelers’ Sentiments on the New Normal. Department of Tourism, Asian Institute of Management, Guide to the Philippines. https://guidetothephilippines.ph/ph-travel-survey.

- Experience Philippines. (2020, May). How Filipinos view traveling after COVID-19 flattens? https://www.experience.ph/poll-how-filipinos-view-traveling-after-covid-19-flattens/.

- Filinvest Hospitality Corporation and Chroma Hospitality Inc. (2020, June). Domestic travel sentiment survey. https://indd.adobe.com/view/30521fd3-30fa-4ba2-b165-919e100569c3?fbclid=IwAR05IrayFDrJfKvoCfq5CDyzxcdawAra34OO_NuRXAidwU-JzXtcmYAsuO0.

- Tajara Hospitality and Horwath HTL. (2020, April). Hotel sentiment survey 2020 (Impact of COVID-19). https://cdn.horwathhtl.com/wp-content/uploads/sites/2/2020/04/Sentiment-Survey_Philippines_Hotels_Covid-Impact.pdf.

- TwoEco, Inc. (2020). Philippine tourism after the pandemic. https://drive.google.com/file/d/1jw57pIvX0fh7l1y739HGk46COUOpRNFI/view.

- Philippine Statistics Authority (PSA). (2020). Contribution of Tourism to the Philippine Economy is 12.7 percent in 2018. https://psa.gov.ph/content/contribution-tourism-philippine-economy-127-percent-2018

- PwC Philippines. (2020, July). Impact of COVID-19 on the Philippine tourism indusry. https://www.pwc.com/ph/en/publications/tourism-pwc-philippines/tourism-covid-19.html.

- United Nations World Tourism Organization (UNWTO). (2020). International Tourist Numbers could fall 60-80% in 2020. https://www.unwto.org/news/covid-19-international-tourist-numbers-could-fall-60-80-in-2020

Dr. Andrew L. Tan Center for Tourism