The Asian Institute of Management’s (AIM) Gov. Jose B. Fernandez Jr. Center for Sustainable Finance (JBF Center) held its first hybrid training workshop on Sustainability and Sustainable Finance for Financial Institutions and Civil Society Organizations on 17 to 18 August 2023. The JBF Center collaborated with Fair Finance Asia – Philippines (FFA–Philippines) and The Initiatives for Dialogue & Empowerment through Alternative Legal Services, Inc. to promote responsible banking and sustainable finance in the Philippines.

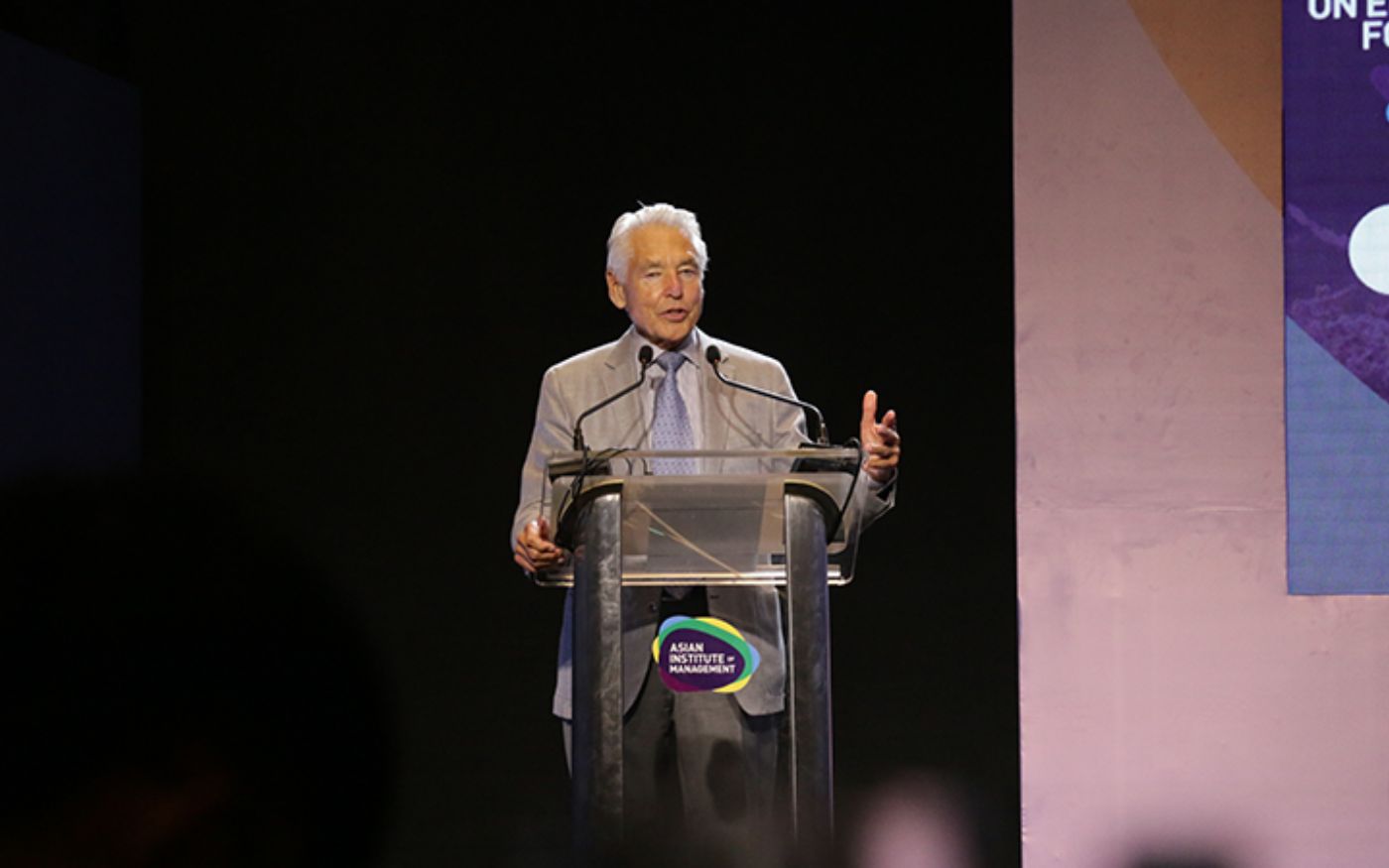

Dr. Felipe O. Calderon, Executive Director of the JBF Center, led the two-day training workshop attended by representatives from various banks across the country as well as various Civil Society Organizations (CSOs). The workshop covered various topics presented by eight resource persons from diverse backgrounds with the primary focus on educating the participants on how to integrate environmental, social, and governance considerations into their organizations’ operations and credit risk assessment.

The event was attended by notable resource persons such as the SAVP and Head of Sustainability of Security Bank Corporation, Nikki Lizares; VP and Head of Sustainability of BPI, Jo Ann Bueno-Eala; Research and Advocacy Advisor of Fair Finance Asia, Victoria Caranay; President of Rural Bankers Association of the Philippines, Atty. Mary Ann Tupasi-Saddul; Adjunct Faculty of Ateneo de Davao University, Dr. Maria Angela Zafra; Regional Program Lead of Fair Finance Asia, Bernadette Victorio; and Corporate Banker, Ryan Joseph Larobis.

One of the major highlights of the training was the comprehensive presentation of Atty. Tupasi-Saddul where she thoroughly discussed the major challenges that rural banks face when implementing sustainable finance. Dr. Calderon, on behalf of the JBF Center, pledged to develop a Sustainable Finance Model specifically tailored for rural banks based on the insights shared by the RBAP’s President.

A mix of online and onsite participants attended the workshop with 27 individuals attending in person while 31 joined via Zoom. Attendees gained a better understanding of their role in promoting sustainable finance in their operations and businesses they finance with training also covering the role of CSOs in carrying out research-based advocacies, monitoring, and reporting on responsible banking and sustainable finance. Additionally, participants gained valuable insights into sustainable finance implementation, delved into the different types and risks of greenwashing, and learned best practices from local and international banks.

To download the training agenda, please click here.